While China is enjoying its annul festivities, South Africa has become a center of attention for the ferrochrome and metals industry. The interest is primarily due to the country’s political change, the election of the new president and rapid strengthening of the Rand.

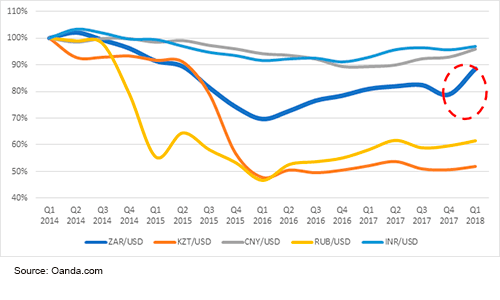

Over the last couple of months, South African Rand (ZAR) has appreciated by around 12% to US Dollar (as shown in the graph below). This jump made Rand one of the fastest growing currencies among all emerging countries.

The strengthening of ZAR does have an unprecedent impact on the South African ferrochrome industry:

-

- The strengthening of the Rand will result in increased cost of production for South African ferrochrome producers. This is turn will impact their relative competitive advantage versus Chinese producers, that was in place during price downturn and weak Rand.

- Still, we believe that appreciation of the Rand will likely force the SA mining and ferrochrome industry to increase the sales price of their respective products, including ferrochrome, chromium ore and UG2.

- Despite possible increase in prices, we see this as an additional step to balance the ferrochrome market.

One of the main reasons for strengthening of the Rand was election of Cyril Ramaphosa as the new president of South Africa. His view on economy, specifically the mining sector showed that finally the government will address the issues plaguing the industry over the last decades. Furthermore, there is a strong believe that he will scrap completely the new Mining Chapter, thus attracting more investors in the country.

In conclusion we see both events as an important step in the history of the South African ferrochrome industry and expect it finally to get out of the recession.