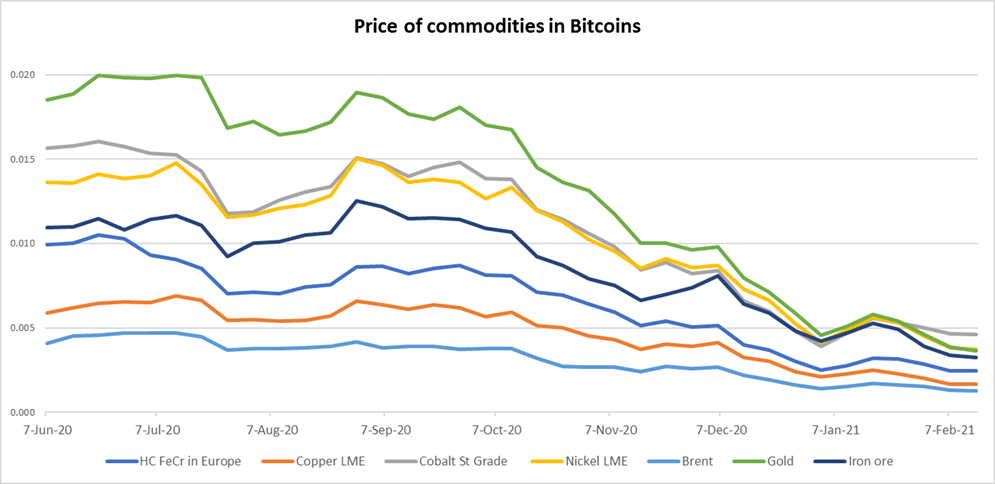

Let us imagine for a moment that commodities are priced in Bitcoins* – we would be witnessing commodities hitting some of the lowest price levels, and panic/uncertainty spreading over the market:

Luckily for the people involved in commodity industries, commodities are still priced in FIAT currencies (mainly in USD), and right now are experiencing a sizeable price increase, as seen in the graph below:

Prices scale: HC FeCr Europe: US cents per lb; Copper LME: USD per 10kg; Cobalt St Grade: USD per 10lb; Nickel LME: USD per 10kg; Brent: USD per barrel; Gold: USD per 1/10 of an ounce; Iron ore: USD per tonne

One of the main reasons for rapid price surge of Bitcoin, is believed to be inflation fears and investors attempt to hedge against further inflation increase. Inflation is one of the concerns going forward for global economic recovery.

The graph below is another good illustration for the present strong commodities market performance and historic inflationary cost pressure correlation with wide commodity cycle, which hopefully will continue and help commodities market to recover to the level of long-term sustainability.

Historically commodities were deemed the main protection against inflation, as shown in the graph below. Given the FIAT currency volatility, it is possible that after some time, commodities prices denominated in Bitcoins will start upward push.

With the latest report that commodities are entering a new supercycle, it will be of no surprise, if the upward movement for commodities prices will be even sharper than what we are seeing right now, especially after those prices have been at their lowest levels in the last decade.

* Bitcoin grew from 9,500 to 50,000 USD per Bitcoin.